In the ever-evolving world of cryptocurrencies, mining remains a cornerstone of the digital currency ecosystem. As beginners embark on their journey into this fascinating realm, understanding how to calculate profits from hosted mining machines is pivotal. Hosting services have revolutionized the landscape, allowing individuals to engage in mining without the burden of physical setup. This article will guide you step-by-step, illuminating the profit calculation journey for those keen on cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG).

When it comes to profit calculation, the first step is understanding the basics of mining. Mining involves validating transactions on the blockchain, which, in essence, is a decentralized ledger. Miners utilize specialized hardware, known as mining rigs, to solve complex mathematical problems. Those who succeed are rewarded with cryptocurrency, which is vital in determining profitability. With hosted mining, miners can leverage robust infrastructure maintained by third-party providers, reducing the need for costly hardware purchases and maintenance.

To calculate profits, one must first ascertain several key factors: the hash rate of the mining machine, the mining difficulty, the cost of electricity, and the current market value of the mined cryptocurrency. Each of these variables plays a critical role in shaping the overall profitability. The hash rate represents the speed at which a mining rig operates, while mining difficulty adapts to the total network hash rate to maintain consistent block times.

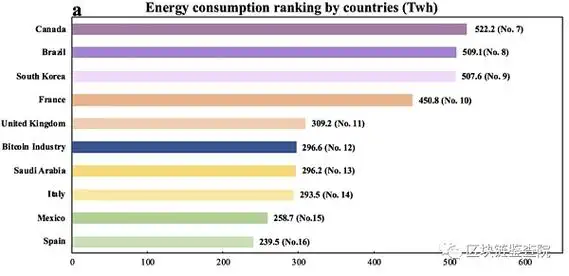

Next, let’s explore the cost of electricity—an often-overlooked component. Mining rigs can consume an immense amount of power, which can significantly eat into profits. It’s essential to calculate your local electricity rates and estimate how much power the machine will require over a given period. The profitability equation will start taking shape once you juxtapose the earnings from mined cryptocurrency against these operational costs.

For example, if you host a mining machine with a hash rate of 100 TH/s, and the current BTC mining difficulty is 20 trillion, you can calculate your likelihood of earning a block reward, which is derived from the competition amongst miners. Suppose a miner earns 0.0001 BTC daily. At Bitcoin’s current value, multiply this by the current market rate to gauge your daily revenue. This figure must then be matched against the electrical costs and hosting fees to establish your net profit.

It’s crucial to keep in mind that fluctuations in cryptocurrency prices can dramatically influence your earnings. Virtual currencies are notoriously volatile, so it’s prudent to monitor these market movements regularly. A spike in BTC can significantly enhance your profits, while a slump could lead to losses if not calculated or mitigated properly.

Additionally, hosted mining services often come with subscription models or contracts that outline fees that must be paid to maintain your hosting arrangement. These charges can vary based on the service provider and may include costs for maintenance, cooling, power, and additional features. Therefore, comparing packages from different hosting companies is advisable to optimize your profitability equation.

Now, let’s consider the long-term implications. Regularly recalculating profits is vital, as new mining technologies and upgraded hardware develop continuously. As more efficient mining machines enter the market, older models may become less profitable. Staying informed about advancements in mining technology, energy efficiency, and market dynamics should be a routine part of your profit calculation strategy.

Moreover, diversifying your cryptocurrency investments, beyond just BTC or ETH, into emerging currencies like Dogecoin (DOG) can yield varying returns. Each currency comes with its unique market force, mining difficulty, and community sentiment that can affect its price and profitability outlook. Experimentation with different currencies can unearth potential profit avenues.

Lastly, community engagement is invaluable for any beginner in the mining sphere. Online forums and social media platforms are filled with experienced miners who can offer insights and tips regarding profit calculation or investment strategies. Networking within this ecosystem can reveal hidden opportunities or pitfalls that may not be immediately apparent to newcomers.

In conclusion, calculating profits from hosted mining machines requires comprehensive knowledge of several factors. By understanding hash rates, mining difficulty, electricity costs, and market conditions, beginners can navigate the complexities of cryptocurrency mining. As the industry continues to evolve, so too will the methodologies for profit calculation. Embarking on this venture not only offers potential financial rewards but an expansive journey into the intricate world of blockchain technology.

This guide offers a comprehensive breakdown of calculating profits from hosted mining machines, catering to beginners. It covers essential metrics like hash rate, energy costs, and market volatility, providing practical examples and tools. Readers will appreciate the accessible explanations and diverse strategies, ensuring they grasp the complexities of mining profitability.