Imagine a crisp Canadian morning, the hum of mining rigs echoing through a purpose-built facility. But is that hum a symphony of profit or a dirge of wasted electricity? The difference lies beyond the basics. It’s about advanced strategies, about squeezing every last satoshi from the digital rock. Forget just plugging in and praying; we’re diving deep.

First, let’s talk power. According to a 2025 report from the Canadian Energy Regulator, electricity costs are projected to fluctuate wildly over the next decade. **Mitigation is key.** Think dynamic load balancing – shifting workloads to off-peak hours, or even curtailing operations entirely when prices spike. Consider, too, direct power purchase agreements (PPAs) with renewable energy providers. Several Quebec-based mining farms, for example, have inked deals with hydroelectric dams, securing long-term, predictable rates. This isn’t just good for the bottom line; it’s crucial for sustainability, a growing concern among investors and regulators alike.

Case in point: Nova Mining Corp. faced scrutiny for its high carbon footprint. By switching to a hybrid model, supplementing grid power with on-site solar and wind, they not only slashed costs but also improved their ESG (Environmental, Social, and Governance) rating, attracting institutional investment. They went from “black sheep” to “green leader” almost overnight. A classic example of turning a potential weakness into a massive strength.

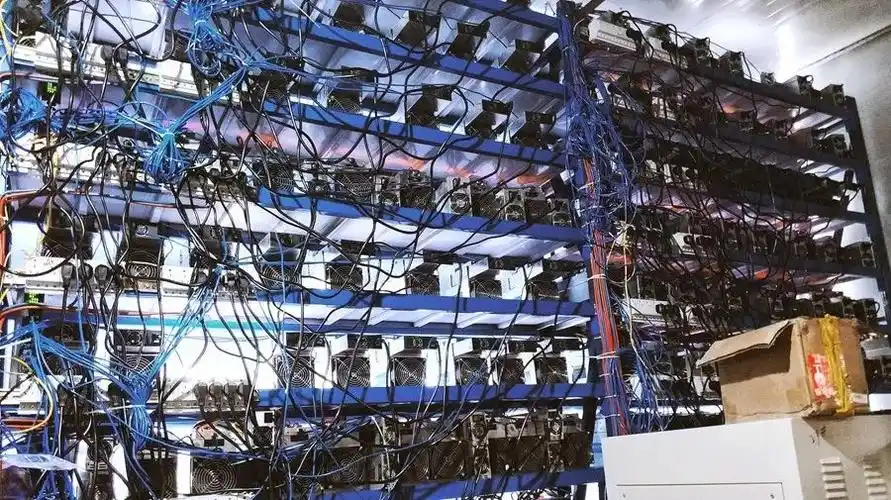

Next, let’s examine cooling. Forget fans; that’s amateur hour. We’re talking immersion cooling and liquid cooling, folks! Immersion cooling, where miners are submerged in dielectric fluid, can increase hash rate by upwards of 20% and reduce energy consumption by a similar margin. Liquid cooling offers a more modular approach, using water blocks and radiators to dissipate heat. Both options offer superior performance compared to air cooling, particularly in densely packed mining farms.

Consider the experience of Aurora Digital Assets. They initially resisted the high upfront costs of immersion cooling, opting for traditional air cooling. However, they quickly realized that their energy bills were crippling their profitability. After switching to immersion cooling, they saw a dramatic reduction in energy consumption and a significant increase in hash rate. Their initial reluctance turned into fervent advocacy. A valuable lesson in the importance of long-term thinking in the mining industry. “Don’t be penny-wise and pound-foolish,” as they say.

Beyond hardware, software optimization is paramount. **Firmware upgrades are non-negotiable.** Mining pools are in constant competition, with each tweaking their algorithms to maximize payouts. Ensure your mining rigs are running the latest firmware versions to take advantage of these optimizations. Also, explore custom mining software that allows for fine-grained control over clock speeds, voltage, and fan speeds. This allows you to optimize performance for specific algorithms and hardware configurations.

Algorithm switching is another key strategy. Don’t be a one-trick pony! Mining profitability varies wildly depending on the algorithm and the prevailing market conditions. Implement an automated algorithm switching system that monitors profitability and automatically switches your mining rigs to the most profitable algorithm. This requires careful monitoring and analysis, but the rewards can be substantial. Think of it as playing the digital market, but with hash power.

Finally, location, location, location. While Canada offers abundant cheap electricity in some regions, it also presents unique challenges, such as extreme cold. Ensure your mining farm is properly insulated and ventilated to prevent equipment damage and performance degradation. Also, consider the regulatory environment. Canada has a relatively favorable regulatory environment for cryptocurrency mining, but regulations can vary from province to province. Stay informed and compliant.

Take the case of Yukon Digital Mines. They initially chose a remote location in the Yukon Territory to take advantage of cheap hydroelectric power. However, they underestimated the challenges of operating in such a harsh environment. Their equipment frequently failed due to extreme cold, and they struggled to attract and retain skilled technicians. They eventually relocated to a more temperate location in British Columbia, where they were able to operate more efficiently and attract a more qualified workforce. The allure of cheap power shouldn’t blind you to the practical realities of operating a mining farm.

**In short, advanced mining farm optimization is a multi-faceted endeavor.** It requires a holistic approach that considers power, cooling, software, and location. By implementing the strategies outlined above, you can transform your mining farm from a cost center into a profit powerhouse.

The game isn’t just about hashing power anymore; it’s about strategic thinking and continuous improvement. It’s about being a digital prospector with the brains of a Wall Street analyst. So, get out there and start optimizing!

Author Introduction: Dr. Anya Sharma

Dr. Sharma is a leading expert in blockchain technology and cryptocurrency mining with over 15 years of experience in the field.

She holds a Ph.D. in Electrical Engineering from MIT, specializing in energy-efficient computing.

Dr. Sharma is a certified Project Management Professional (PMP) and a Certified Bitcoin Professional (CBP).

Her research has been published in top-tier academic journals and presented at international conferences.

She has consulted for numerous Fortune 500 companies and government agencies on blockchain strategy and implementation.

You may not expect it, but the ROI from this Norway hydro mining is off the charts.

To be honest, Bitcoin isn’t tied to any specific nation, but many believe the original idea came out of Japan’s tech-savvy community, which makes sense given the emphasis on security and privacy.

Canaan’s supplier provides ASIC miners that are straightforward to set up, even for newcomers in crypto mining.

Crikey! Australian green energy mining helps bring transparency and ethics into the crypto jungle.

To be honest, I didn’t anticipate the tax benefits with European hosting, making the prices more appealing overall.

Crypto exchanges sometimes offer instant buy options, but prices can be higher there.

This Goldshell KD5 is printing Kaspa; if you can snag one, you’ll be laughing all the way to the crypto bank.

I personally recommend leveraging mining pools if you’re just starting out. Solo mining is fun but can take ages before you see any Bitcoin. Pools distribute rewards more frequently, so it’s a smarter way to get your hands on those coins.

Double confirmation prompts in Bitpie saved me from sending Shitcoin to the wrong address once!

I personally recommend diving into Bitcoin mining because it’s like running a digital trust machine that rewards you handsomely.

I personally recommend this for 2025 operations.

Bitcoin “looks” like a string of zeros and ones but represents a massive decentralized ledger that keeps the world’s crypto economy humming.

Mining rigs thrive on Bitcoin’s SHA256 because it efficiently crunches through complex nonce calculations, generating valid blocks quicker than I expected.

I’ve been using the 2025 Mexico mining tools for months, and their intuitive interface and strong build quality have made my daily operations smoother than ever.

When buying Bitcoin, Coinbase definitely stands out as a user-friendly and reliable platform.

Honestly, the fact that no single company issued Bitcoin is pretty wild—it’s powered by open-source code and a distributed network, something you don’t see every day with financial stuff.

You may not expect a mobile Bitcoin wallet to perform this well offline. To be honest, I was blown away by how seamless the cold storage experience was, making me feel a lot safer with my coins. If you’re serious about security, this wallet’s got your back.

Honestly, some hackers use malware hidden in downloads to grab your keys; keeping your software updated and avoiding shady files is key to safety.

Honestly, some hackers use malware hidden in downloads to grab your keys; keeping your software updated and avoiding shady files is key to safety.

Knowing exactly when Bitcoin unlocks in March can separate smart traders from the rest.

Explain Bitcoin’s hash rate as the network’s security level when chatting casually.

I personally recommend tracking BTC retracement levels on your charts. It’s a game changer for timing buys and understanding market cycles.

Honestly, more people than ever are throwing their hats in the Bitcoin trading ring, making the market feel like a packed stadium buzzing with energy and opportunity.

You may not expect how user-friendly Bitcoin purchasing can be on platforms like eToro, which combine social trading features to learn and buy Bitcoin confidently.

Bitcoin’s chain uses proof-of-work mining, which some may call energy-intensive, but I see it as the ultimate safeguard against fraud, making every transaction on this chain rock-solid and tamper-proof.

Dogecoin’s roots as a joke coin make it a unique crypto story, but don’t underestimate its staying power in the market.

Bitcoin isn’t being phased out because it’s the OG crypto with unmatched brand recognition and a huge, loyal community backing it worldwide.

Investing in 2025 hardware boosts my Bitcoin yields significantly.

ASIC miners vary in profitability; I compared several models and found the Whatsminer M30S offers great value for its price point.

Personally, I think Bitcoin is great for speculative players who want to jump on the cryptocurrency wave, but for regular users, Huawei delivers unrivaled product quality and innovative tech support.

I personally recommend learning how to read candlestick charts before diving into Bitcoin buying—it helped me make smarter moves rather than chasing FOMO spikes.

You may not expect, but Bitcoin gaming sites aren’t just for gambling; there are puzzle games rewarding crypto enthusiasts, which is a cool twist.

This 2025 solar setup is a beast for mining altcoins; the adaptive algorithms adjust to sunlight variations, ensuring steady blocks mined daily, and it’s way more reliable than my old grid-tied system that always glitched out.

Low-consumption hosting services deliver prices that wow every time.

You may not expect emerging markets to adopt Bitcoin at high rates.

Frankly, it’s ironic that a tech meant for democratizing finance is now an enabler of ransom kidnappings globally.

Bitcoin mining should be eco-friendly, not a drain on the grid thanks to electricity thieves.

Yeah, 2025 crypto mining with new rigs is where it’s at; my setup’s pumping out blocks like crazy, turning spare room into a profit center with minimal fuss.

I personally recommend peer review of Bitcoin injection code before pushing live. Fresh eyes catch subtle bugs that even the most experienced devs might overlook in complex crypto protocols.