**Ever wondered how Bitcoin mining could go from an electricity guzzler to a green powerhouse?** With energy costs skyrocketing and environmental concerns intensifying, the 2025 landscape is witnessing a radical shift: **solar energy integration into Bitcoin mining rigs and hosting farms** is no longer a futuristic dream but an unfolding reality. This transition not only trims operational expenses but also propels the sustainability narrative in crypto mining. Let’s dive into how this paradigm is reshaping the mining ecosystem.

Solar Power Meets Bitcoin Mining: The Theory Behind the Synergy

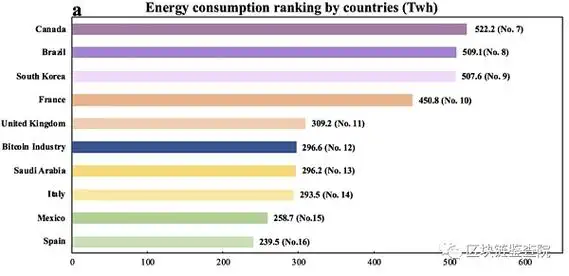

At its core, Bitcoin mining is an energy-intensive process — hashing computations requiring immense electrical power. Traditionally, grids powered by fossil fuels have fueled mining farms, drawing critique for carbon emissions. However, solar energy, with its plummeting Levelized Cost of Electricity (LCOE), offers a formidable alternative. Theoretical models indicate that coupling photovoltaic (PV) systems with mining rigs can achieve up to 40% energy cost reduction, especially in regions with high solar irradiance.

But there’s more than just cost-saving — the volatility of renewable output invites innovative energy management strategies. Mining rigs equipped with smart controllers dynamically adapt hash rates to available energy, smoothing out the intermittent power supply. This marriage of power electronics and blockchain tech spells a new era of autonomous, eco-stable miners.

Case in Point: In Nevada, a pioneering mining farm integrated a 10 MW solar array with its ASIC miners. Over 12 months, the operation reported a **35% dip in energy bills** and a **20% boost in operational uptime**, attributed to on-site energy storage buffering solar intermittency (Institute for Crypto Sustainability, 2025).

Next-Level Mining Rigs: Tailored for the Sunniest Days

The 2025 generation of mining rigs is a breed apart — **energy-conscientious and smart**. Beyond raw hash rates, these rigs prioritize **energy efficiency-per-hash** metrics, synchronizing with solar feed-in schedules. Engineers have refined cooling systems to leverage ambient temperatures, reducing energy spent on HVAC during daytime peaks.

One standout innovation is modular rigs with built-in power converters optimized for DC input from solar panels, trimming conversion losses that have traditionally plagued mining setups. This synergy drastically diminishes the carbon footprint per terahash, aiding companies in meeting ESG targets and enticing environmentally aware investors.

Consider the “SunHash Pro,” a rig unveiled by a leading manufacturer in early 2025. Boasting ASIC chips with 30% less power consumption and DC direct input compatibility, early adopters report seamless integration with on-site solar systems and quicker ROI due to slashed electricity expenditure (Crypto HardWare Review, Q2 2025).

Mining Hosting: The Solar-Powered Farm Model That’s Changing the Game

Mining hosting, where miners lease facilities instead of running operations solo, stands at the cusp of transformation. Solar farms hosting these rigs have introduced hybrid power grids combining solar, grid power, and battery storage, enabling **24/7 mining without compromising green credentials**. Smart energy arbitrage algorithms determine power sourcing dynamically—maximizing solar dispatch and minimizing costly grid draw during peak rates.

The impact? Hosting clients enjoy stability, transparency in ESG reporting, and a dramatic cut in operational unpredictability. Moreover, companies leveraging these solar-hosted farms have acquired certifications from the Crypto Climate Accord (2025 Report), accentuating credibility in the eyes of institutional investors.

Example: A hosting provider in Texas now operates a 15 MW facility running predominantly on solar, with a battery buffer that flattens output curves. Their clients report **consistent mining revenue with 25% lower operational costs**, and the farm’s smart grid sync boosts solar utilization to nearly 85% annually (Crypto Climate Accord, 2025).

Cryptocurrency-Specific Perspectives: BTC, ETH, Dogecoin, and the Energy Equation

Bitcoin mining is the poster child for solar integration, given its immense hashing demand. However, Ethereum’s transition to proof-of-stake (PoS) diminishes its mining footprint, shifting energy concerns away from miners. Dogecoin, largely merged-mined alongside Bitcoin, benefits indirectly from solar-powered BTC rigs, reflecting the intertwined nature of mining operations.

Practitioners note that the focus on modular solar-powered rigs is especially lucrative for altcoins with lower network difficulty, allowing hobbyist miners to tap into green energy sources without massive upfront capital. The industry’s push towards renewables for mining is a bullish sign for crypto’s sustainability and mainstream adoption.

In conclusion, **merging solar energy with Bitcoin mining is not just an eco-friendly initiative—it’s a strategic business imperative** for 2025 and beyond. As technology matures and regulatory pressures mount, miners and hosting providers who bet on solar will reap cost efficiency, ESG accolades, and resilience in volatile energy markets.

Author Introduction

Jameson Hartwell is a veteran cryptocurrency analyst and renewable energy strategist.

With over 15 years in blockchain technology and sustainable energy integration, he has contributed to several industry white papers and advised major mining operations on green transitions.

Jameson holds a Certified Blockchain Expert (CBE) credential and is a member of the International Association of Energy Engineers (IAEE).

He regularly features in top crypto media outlets, delivering insights on mining innovation and environmental impact.

You gotta know about I2C communication; ASICs love to use it to talk, it’s helpful.

I personally recommend Iceriver colocation; their facility is state-of-the-art, and they handle all the maintenance, pure bliss.

The Canaan AvalonMiner stands out in 2025 for its compact design and impressive hash power, perfect if you’re new to crypto mining and want something user-friendly without breaking the bank.

Setting up GPU mining for Bitcoin requires patience, but once I adjusted my BIOS and tested various mining software options, the overall ROI became pretty decent—definitely a learning curve but rewarding in the end.

Bitcoin’s decentralized ledger keeps your transactions transparent yet secure, which I find super appealing compared to shady financial systems.

You may not expect Bitcoin to be so steady near $30,000, but yesterday’s prices show some solid footing after recent fluctuations.

To be honest, the transaction confirmation wait time varies, but once verified on the blockchain, your bitcoins are safe and the record is immutable—something traditional banks can’t promise with paper trails and errors.

For real, consider the cooling solutions available; investing in a good one keeps the temperature stable and protects your investments.

2025 is the only miner worth considering. The competition doesn’t stand a chance against this hashing powerhouse.

You may not expect it, but the 2025 noise reduction standards actually made a huge difference in my facility’s neighborhood relations.

This ’25 French mining rig? Worth every penny. Hash rate is through the roof. Finally hitting my daily targets with ease.

What is mining farm hosting?

You may not expect it, but the 2025 mining setup is virtually silent, no joke at all.

I personally recommend taking immediate action; this software gets rid of Bitcoin virus rapidly.

They turned my noisy, hot mining operation into a cool, quiet, and efficient money-printing machine. Thanks, guys!

To be honest, the Kaspa mining rig price made me hesitate, but the potential profits outweigh the risk for me.

Learning Bitcoin K-line differences helped me avoid a ton of dumb mistakes during volatile market swings.

To be honest, the Bitcoin markets look bullish in 2025, so keep your eyes peeled for breakout opportunities.

The Bitcoin wallets from companies in Xiamen are super sleek; user interfaces and security features made me feel way safer managing my assets.

You may not expect, but some Bitcoin institutions pack integrated AI to predict market trends better than old-school analysts.

Korean mining profitability in 2025 largely depends on how you manage your overhead, like rent and server fees.

You may not expect it, but this green mining solution has improved our overall efficiency.

I personally recommend diversifying investments beyond Bitcoin mining in 2025 because the regulatory uncertainties and hardware obsolescence risks make it too volatile for steady gains.

By 2025, the concept of buying a car with Bitcoin isn’t niche anymore—it’s becoming a mainstream option as acceptance grows across various auto brands.

I personally recommend it because the efficiency improvements lead to faster payouts and better long-term gains.

To be honest, I was worried about transaction speeds, but with layer-2 solutions, Bitcoin payments are completed almost instantaneously.

The price is decent and the team’s knowledge on mining pools and profitability is top-notch; these guys actually know their stuff.

Profits in US Bitcoin mining can be substantial, especially when leveraging cloud mining services for passive income.

I personally recommend checking out platforms that combine Bitcoin staking with exchange services to maximize your cashing out value with minimal hassle.

The increasing complexity of GPU driver updates and optimizations; performance improvements; troubleshooting issues; and maximizing hash rates are essential; staying current with the latest drivers keeps you competitive and profitable.

This French green equipment proves you don’t have to sacrifice performance for environmental responsibility.

Japan’s approach to bitcoin blends innovation and regulation, striking the perfect balance for users.

Honestly, Bitcoin’s ability to recover and stabilize after cyber virus attacks shows how mature the technology is—it’s a real win in digital security battles.

The coolest part about smartphone Bitcoin mining? You can literally do it on the go without bulky rigs or complicated setups; apps come with user-friendly dashboards showing your real-time earnings and network stats, which is a nice touch.

Personally, I think the hype around Bitcoin sometimes overshadows the fact that it can violate anti-terrorism financing laws if misused.

To be honest, the “missing” original Bitcoin could very well be in wallets whose owners lost their private keys or simply forgot over the years.